Introduction

“Indian property developers fear a crash.”

“Real estate stocks are tumbling.”

“Buyers are sitting on the fence.”

If you’ve been following news headlines, LinkedIn takes, or even Reddit threads, you’ve probably seen some version of this narrative. A real estate slowdown, especially in Bangalore and across India, is being painted as an impending collapse. But when you step back and look at the ground reality, the story is far less dramatic and far more logical.

What’s actually happening isn’t new. The market is simply accelerating trends that were already visible as early as 2025.

Yes, we’re in a phase of turbulence. AI is rapidly reshaping industries, jobs, and capital allocation in ways we’ve never experienced before. Layer that with ongoing geopolitical uncertainty, and it’s only natural for both buyers and investors to move with caution.

But this is not a collapse, it’s a recalibration. Buyers are more intentional, developers are more selective, and capital is more disciplined. Demand hasn’t vanished; it has evolved. What we’re seeing is a market shedding excess and returning to fundamentals: location, livability, value, and long-term utility.

Real Estate 2025: The Year that was

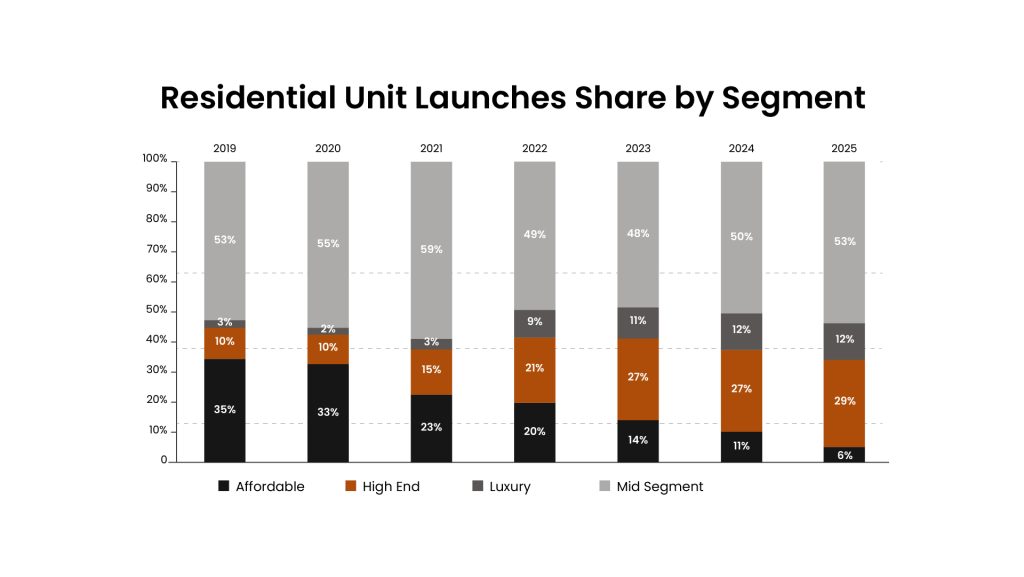

India’s residential real estate market has clearly moved past its post-pandemic adrenaline rush. According to PropTiger.com’s latest annual report, Real Insight – Residential CY 2025, housing price growth across the top eight cities cooled to about 6% in 2025, down from a sharp 17% jump in 2024. The difference is 11 percentage points, so you can clearly see that the housing price growth cooled by 11 points from 2024 to 2025.

But wait, what does it mean?

This slowdown doesn’t signal stress. Instead, it points to a market that’s settling into a healthier rhythm, with supply more measured, pricing disciplined, and transaction volumes easing slightly after two consecutive years of strong momentum.

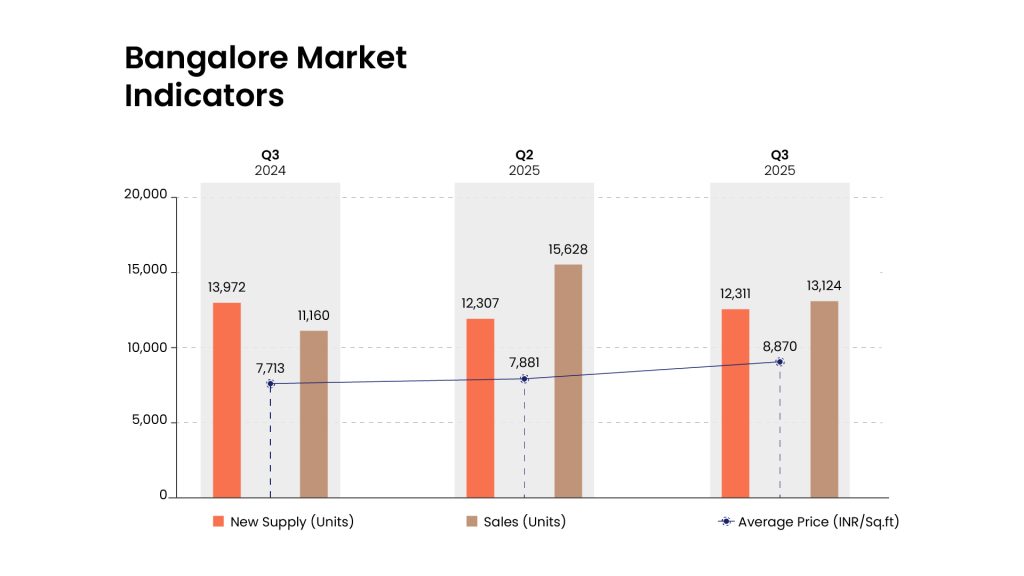

This was the overall Indian residential market; meanwhile, Bangalore went the other way on supply and how.

The city clocked a record 12,149 unit launches in Q4 2025 alone, marking a 16% year-on-year increase. What’s notable is the consistency: quarterly launches stayed above the 12,000-unit mark through the year, underlining the market’s depth. Festive-season demand only added fuel to this momentum.

The East submarket led the charge. Whitefield and Hoskote together accounted for roughly 45% of quarterly launches. Close behind were the South and South-East corridors—Sarjapur Road, Kanakapura Road, Bannerghatta Road and Electronic City, which together contributed 39%. North Bangalore, including Devanahalli, Thanisandra Road and Yelahanka, made up the remaining 16%.

Zooming out to the full year, Bangalore saw 49,252 units launched in 2025—the highest ever and a solid 28% jump over 2024. Southern submarkets dominated with a 40% share of annual launches, followed by North Bangalore at 34%, while East Bangalore contributed around 23%.

What Has Actually Changed Since 2010? A 15-Year Perspective

If you take a step back and look at Bangalore’s real estate journey over the past fifteen years, the transformation is clear and measurable:

- Property prices have nearly tripled

- Home sales volumes have doubled

- Office space absorption has steadily expanded

This growth was not driven by speculation. It has been structural.

The consistent expansion of IT/ITES, the rapid rise of Global Capability Centres (GCCs), growth in aerospace and other emerging industries, alongside sustained infrastructure investment, has created genuine, end-user-led housing demand. This is fundamentally different from short-term, sentiment-driven market spikes.

Why Does Price Growth Feel Sudden?

The perception of sharp escalation often comes from looking at recent years in isolation.

Between 2010 and 2021, it took nearly a decade for average residential prices to double — from approximately ₹3,150 per sq ft to ₹6,150 per sq ft.

However, in the following four years, prices increased by another 50%, reaching nearly ₹9,260 per sq ft by 2025. The sharper rise between 2023 and 2025 (₹7,120 to ₹9,260 per sq ft) is what created the sense that the market was overheating.

There has been some moderation in momentum more recently, which is natural. Real estate cycles rarely move in straight lines.

Price resilience tends to remain strongest in micromarkets anchored by employment hubs, quality educational institutions, and well-developed social infrastructure. When growth is supported by sustained job creation and infrastructure development, it reflects underlying strength rather than bubble-like behaviour.

Key Real Estate Market Trends 2026*

(* Colliers India Annual Report)

Lifestyle and sustainability are shaping homebuying decisions

In 2026, homebuyers are expected to focus more than ever on lifestyle and sustainability. The demand for plotted developments, gated villas, premium homes with concierge services, and even vacation homes in offbeat destinations is likely to stay strong. Buyers are clearly looking for more space, wellness-focused designs, and experiences, not just square footage. At the same time, green homes powered by smart technologies and energy-efficient materials will gain traction, supported by government incentives and growing environmental awareness among consumers.

Redevelopment to redefine urban skylines

India’s major cities—Mumbai, Delhi NCR, Bengaluru, Chennai, Kolkata, and others—are set to see steady transformation through redevelopment. Older buildings are making way for modern, resilient structures, thanks to supportive FSI policies, TDR frameworks, and updated urban planning norms. However, successful redevelopment will depend heavily on smooth collaboration between government authorities and private developers to create well-planned, future-ready neighbourhoods.

Fringe areas are becoming the next growth hubs

Peripheral and suburban areas in Tier I cities are expected to gain serious momentum in 2026. With expressways, metro expansions, new corridors, and greenfield airports improving connectivity, these micro-markets are becoming increasingly attractive. Better infrastructure is unlocking new residential pockets and making housing more accessible. For many buyers, these fringe localities offer budget-friendly options while still staying connected to the city’s core.

Tier II & III cities entering the spotlight

Beyond metro cities, Tier II and III markets, including spiritual and temple towns, are emerging as strong growth centres. Urbanisation, improving infrastructure, and favourable demographics are driving demand. As reputed developers expand into these markets with premium offerings, property prices in these cities could see annual growth of 10–15%, signalling long-term potential.

Fractional ownership is gaining ground

Fractional ownership is slowly becoming a popular entry point into premium residential real estate. It allows multiple investors to co-own luxury homes, vacation properties, or high-end apartments at a lower ticket size. The model offers flexibility, liquidity, and passive income opportunities. That said, its sustained growth will depend on clear regulations and strong digital systems that ensure transparency and build trust in shared ownership.

Will the Real Estate Market Crash in 2026?

A crash in 2026 appears unlikely because India’s real estate market is supported by strong structural demand. The country already faces a housing shortfall of around 10 million homes, and this gap could expand to nearly 30 million over the next decade due to urbanisation, rising incomes and growing nuclear families. These fundamentals create sustained end-user demand rather than speculative excess.

However, after several years of rapid price appreciation, the market may enter a period of consolidation. Instead of a sharp decline, 2026 is more likely to witness price stability, slower sales velocity and improved negotiation power for buyers. In short, it would be a phase of pause and balance rather than a plunge.

Conclusion:

The narrative around a 2026 real estate crash makes for dramatic headlines, but the data tells a different story.

Bangalore’s real estate market is not collapsing—it is realigning. After a period of accelerated growth, the market is transitioning into a phase of consolidation marked by disciplined pricing, measured supply, and more informed buyers.

Over the past 15 years, the city’s growth has been structural, not speculative. Property prices have risen alongside genuine economic expansion, office absorption, infrastructure upgrades, and employment growth. These fundamentals remain intact.

2026 is unlikely to be a year of decline. Instead, it may represent something healthier:

A market that rewards quality over hype.Value over velocity. Long-term fundamentals over short-term sentiment.

For serious homebuyers and long-term investors, stability is not a warning sign; it is an opportunity.

Frequently Asked Questions (FAQs)

- Will Bangalore’s real estate market crash in 2026?

A crash in 2026 is unlikely. Bangalore’s real estate market is supported by strong end-user demand driven by IT/ITES growth, Global Capability Centres (GCCs), infrastructure expansion, and urban migration. While price growth may moderate after rapid appreciation between 2023 and 2025, the market is expected to stabilise rather than decline sharply.

- Is 2026 a good time to invest in Bangalore real estate?

Yes, 2026 could be a strategic time to invest. With price momentum cooling and supply at record highs, buyers may benefit from better negotiation power, attractive payment plans, and wider inventory choices—especially in growth corridors like Whitefield, Sarjapur Road, North Bangalore, and Electronic City.

- Why did Bangalore property prices rise so sharply between 2023 and 2025?

The sharp increase was driven by post-pandemic demand, rising construction costs, strong office space absorption, and increased launches in premium segments. Average residential prices rose from around ₹7,120 per sq ft in 2023 to nearly ₹9,260 per sq ft by 2025, creating the perception of overheating. However, this growth followed nearly a decade of relatively moderate appreciation.

- Which areas in Bangalore will grow the most in 2026?

In 2026, Bangalore’s growth is largely driven by infrastructure, with certain micro-markets clearly leading the momentum.

Sarjapur Road and the fast-developing Sarjapur–Chikka Tirupathi corridor are among the top-performing belts, supported by their proximity to the upcoming SWIFT City and the Satellite Town Ring Road (STRR). North Bangalore continues to maintain strong momentum, driven by expansion around the international airport, business parks, and large-scale infrastructure upgrades. Whitefield remains a stable and mature IT hub with established metro connectivity and social infrastructure.

- Are fringe areas in Bangalore a good investment in 2026?

Yes. Peripheral and suburban locations are gaining traction due to improved connectivity through metro extensions, expressways, and airport corridors. These micro-markets offer relatively affordable entry prices and strong long-term appreciation potential.

- How does Bangalore compare to other Indian cities in real estate growth?

Unlike speculative spikes seen in some markets historically, Bangalore’s growth has been largely structural—anchored by employment generation in technology, aerospace, and global capability centres. Consistent office absorption and sustained job creation continue to support housing demand.

- Will property prices fall in Bangalore in 2026?

A sharp fall is unlikely. Instead, 2026 may bring price stability and slower growth. Developers are becoming more disciplined with supply, and buyers are more selective, leading to a healthier, balanced market cycle.

- What real estate trends will shape 2026 in India?

Key trends include: a)Increased demand for sustainable and smart homes, b) Growth of gated communities and plotted development,s c) Redevelopment in core city areas, d) Rising interest in Tier II and Tier III cities, e)Expansion of fractional ownership models

- Is fractional ownership safe in India?

Fractional ownership is gaining popularity, particularly for premium and vacation homes. While it offers lower ticket sizes and passive income potential, investors should evaluate regulatory clarity, legal documentation, and platform transparency before investing.

- What factors are driving long-term real estate demand in India?

Major factors include: a) Urbanisation and migration to Tier I cities, b) A housing shortfall of nearly 10 million homes, c) Rising disposable incomes, d) Nuclear family growth, e)Infrastructure expansion and employment hubs. These structural factors reduce the likelihood of a systemic market crash.

Read our Latest Blogs

Is Bangalore Real Estate Cooling or Crashing in 2026?

Buying & Investing Insights

- February 17, 2026

- 16 min read

Sale Agreement Vs Sales Deed: Essential Guide to Key Features and Importance

Real Estate Basics

- February 6, 2026

- 13 min read

Understanding Floor Space Index (FSI): Definition, Calculation, and Significance

Real Estate Basics

- January 27, 2026

- 22 min read

Explore Projects

Independent 4 & 5 BHK Villas

starts @ 4.5 Cr

Sarjapur’s Exclusive 3 BHK Community

starts @ 1.8 Cr

Multi-Gen 2 & 3 BHK Homes

Starts @ 1.87 Cr

Refer & Earn Up to 1%

Invite your friends to explore Modern Spaaces and earn up to 5% of the home value they buy.

Find your Dream Home. Let's talk

Tell us a bit about what you're looking for. One of us will get back to you!